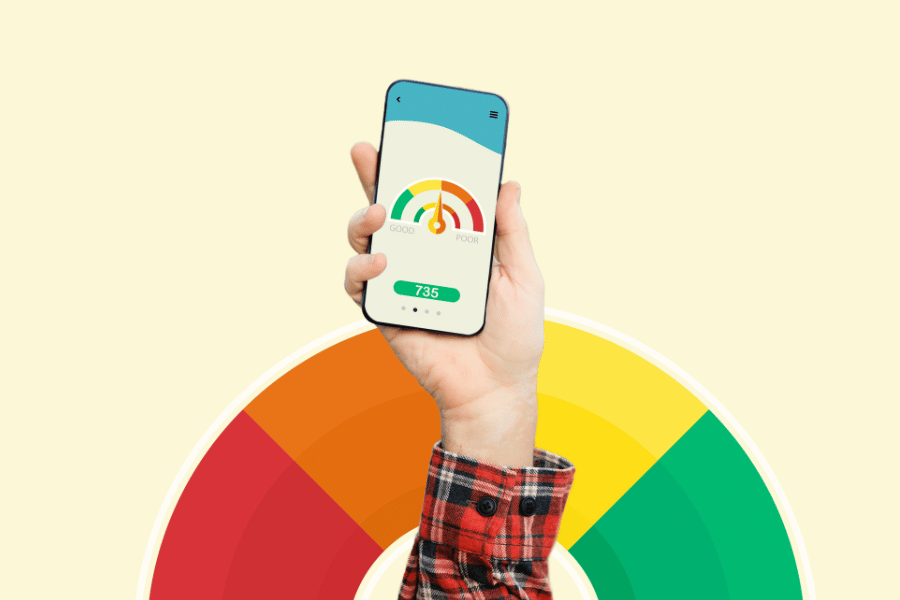

Your credit score is a crucial factor that affects your financial stability and credibility. It is a three-digit number that indicates your creditworthiness to potential lenders, such as banks and credit card companies. A good credit score opens up opportunities for lower interest rates, better loan terms, and more favourable offers.

So, how do you understand and improve your credit score in Australia? Here are some tips:

- Pay your bills on time – Late payments can significantly impact your credit score and remain on your credit report for up to five years. Ensure you pay all bills on time, or set up automatic payments to avoid missing any due dates.

- Keep your credit card balances low – High credit card balances can indicate that you are over-extended and may have trouble making payments. Keep your credit card balances low, and pay off the full balance every month to avoid paying interest.

- Limit your credit applications – Every time you apply for credit, it is recorded on your credit report and can impact your credit score. Limit your credit applications and only apply for credit when you need it.

- Monitor your credit report regularly – Keeping track of your credit report allows you to spot any errors or potentially fraudulent activity. You can obtain a free copy of your credit report from the credit reporting bodies in Australia, such as Equifax, Experian and ills.

By following these tips, you can improve your credit score and secure a brighter financial future. Remember, a good credit score takes time to build, so be patient and consistent in managing your credit.